| Source: Date: Updated: |

TheBahamasInvestor.com

Monday, February 17, 2014 Monday, February 17, 2014 |

Pictured: BHTA President Stuart Bowe. (Photo via BHTA)

The results of the Bahamas Hotel and Tourism Association’s 2013 Industry Performance and 2014 Outlook Survey confirm that 2013 was a year of mixed performance for the hotel industry, while a higher level of business confidence exists for 2014.

Hotels were divided in their responses in gauging revenue and occupancy levels for 2013. In general, Family Island and Grand Bahama hotels reported marginal revenue and occupancy improvements, while Nassau-Paradise Island hotels saw small declines in performance.

While the hotel industry’s 2013 occupancy and rate data compiled by the Ministry of Tourism has not been finalized, preliminary results indicate a year-over-year decline Bahamas-wide of 3.5 per cent in room occupancy and a 4.7 per cent increase in the average room rate.

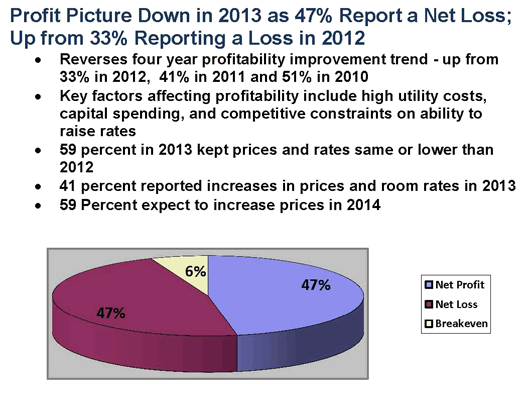

Industry confidence in 2014 is at its highest level since 2007. Despite this, profitability remains a concern as 47 per cent of the responding hotels reported a net loss in 2013, up from 33 per cent in 2012.

Businesses cited high utility costs, investments in capital improvements and constraints on price increases as key factors affecting profits.

BHTA president Stuart Bowe says that “the results mirror the industry’s hotel performance and overall visitor arrivals data for 2013. This tells us that more needs to be done to increase visitor stopover numbers. Stopover visitor expenditure is valued at 20 times more than the cruise guest. The multiplier effect of stopover visitor expenditure is crucial to all stakeholders in our economy.”

Bowe pointed to the positive outlook for 2014 as an indication of growing confidence in the future.

“There is a high level of confidence in the future; however, we hear repeated concern about additional and more affordable airlift, recent and impending tax programmes, high utility costs, and competition from lower-cost destinations. These are real issues for our industry. They are being addressed through collaboration between the public and private sectors and must continue to receive our urgent and collective attention.”

Despite the challenges, the survey highlights that hoteliers have a 97 per cent confidence level for 2014. This is due to an improving global economy, national infrastructural improvements, property upgrades, and new foreign direct investment.

“At the national and industry level is the continuing need to improve the visitor customer service experience by developing and using measurement tools for everything that impacts our tourists.”

“The measurement starts from booking a vacation and every encounter in between until check-out. Service excellence can be the only goal in this global tourism economy full of competitive sun, sand, and sea product offerings. As a high-cost destination, creating value through people interactions is our competitive advantage, and our business goals should reflect this focus. Nothing drives business like word-of-mouth marketing and more recently social media referrals.”

BHTA’s tenth annual survey was conducted during January this year. A representative group of 31 hotels at all size levels and from throughout The Bahamas participated.

Specific results, benchmarked against previous years, are summarized in the annual report:

Profitability weakens, outlook positive

- 40 per cent reported a decrease in revenue in 2013; 51 per cent saw an increase

- 75 per cent anticipate revenue will improve in 2014 and 19 per cent project it will remain constant with 2013 revenue levels

Occupancy levels expected to be stronger in 2014

- 71 per cent forecast an increase in room occupancy levels in 2014

- 26 per cent reported a decrease in occupancy in 2013, while 35 per cent saw occupancies rise

- Stark contrast to 2009 when 85 per cent reported a drop in occupancy

Most properties maintain same employment levels in 2013;

- 34 per cent anticipate additional hiring in 2014

- 59 per cent maintained same employment levels in 2013 and 34 per cent expect to increase employment levels in 2014

- 28 per cent increased levels in 2013, while 13 per cent report a decrease

- 34 per cent expect employment to increase in 2014, while 19 per cent anticipate a decline

Profit picture

- Profits down in 2013 as 47 per cent reported a net loss; up from 33 per cent in 2012

- Reverses four-year profitability improvement trend–up from 33 per cent in 2012, 41 per cent in 2011 and 51 per cent in 2010

- Key factors affecting profitability include high utility costs, capital spending, and competitive constraints on ability to raise rates

- 59 per cent in 2013 kept prices and rates same or lower than 2012

- 41 per cent reported increases in prices and room rates in 2013

- 59 per cent expect to increase prices in 2014

Hotels continue to invest in capital spending

- Capital spending up for 38 per cent in 2013, 25 per cent report a decline

- 23 per cent to spend at same level in 2014 and 34 per cent expect to increase capital spending

Overall outlook for tourism remains positive

- 97 per cent of respondents expressed a fair to positive outlook for 2014

- When asked the same question in 2010, 74 per cent of hoteliers had a negative outlook