| Published: Date: Updated: Author: |

The Bahamas Investor Magazine December 8, 2010 December 8, 2010 Warren Davis |

There are many variables that investors need to consider when developing an investment strategy in the stock market. One of these variables is evaluating the advantages of small cap versus large cap stocks. The term small cap refers to stocks of companies with a relatively small market capitalization, from around $300 million to $2 billion.

There are a number of advantages connected with investing in small cap stocks. One of the biggest is the opportunity to beat institutional investors. Small cap securities also provide a temporary valuation disconnect between the stock price and fundamentals, which presents an opportunity that small cap investors can capitalize on.

Small cap securities also offer investors the chance to be a part of a small, rising company prior to the company experiencing substantial growth. Another advantage of the small cap market is that these securities are thinly traded. As these companies experience dynamic growth in market share and revenues, the demand for their stock increases, and this can result in potential rapid increases in the underlying stock prices for these companies, which translate into capital gains for investors.

Small caps also tend to be cheaper than large cap securities. As a result of the lower cost, investors can invest in a number of securities at a lower cost basis and thus diversify their investment base.

Large caps are those companies that have equity of more than $10 billion. Due to the highly regulated and readily available information, large cap securities represent the least amount of risk when considering an investment in equities. Large cap stocks are not speculative investments and enjoy the benefit of lower volatility and a consistent long-term growth.

Additionally, large cap securities, in most cases, pay dividends, which provides an income stream and makes them extremely attractive to long-term investors. Another major advantage is that they tend to have readily available information, so investors can make sound and informed decisions about these securities.

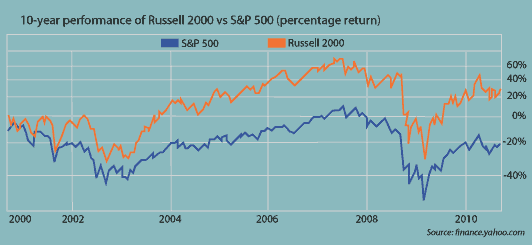

During the last year, there has been a period where practically all stocks, regardless of style or size, have risen, with some stocks rising more than others. However, current market trends show that small caps have an edge over big caps. According to the Russell indexes, small caps have risen to about 95 per cent, while on the S&P 500, large caps are up a relatively modest 68.5 per cent.

This is not a new trend and one that may continue. Small caps have essentially been outperforming large caps for the last decade (see graph), with investors willing to take risks, hoping for big returns from troubled companies, and expectant of an increase in merger and acquisition activity, with smaller companies being viewed as a more attractive target.

The stock market has seen a proliferation of Exchange Traded Funds (ETFs), which are similar to mutual funds, but trade in the stock market. ETFs are attractive to investors that want to partake in the small cap market because they offer the diversification of investing in a number of small cap securities in a particular sector, while lowering the overall risk that an investor would face by investing in any one particular small cap security. Due to the utilization of ETFs, investors can now enjoy the benefits of potential dynamic growth of small cap securities, while minimizing their overall level of risk.

Bio:

Warren Davis

Warren Davis is the managing director of Gibraltar Securities Inc based in Nassau. He is a professional trader and portfolio manager with over 13 years of international and domestic investment training and experience. He is a former president of the CFA Society of The Bahamas.